Build a Crypto Trading Bot in 2026: A Complete Step-by-Step Guide

Crypto trading bot development started more than ten years ago when traders wanted automatic tools to handle crypto trades without resting or waiting. Over 70 percent of trades now use such bots daily in big crypto markets.

Benefits come from fast decisions, accurate tracking, and no emotions during trading which increases profit chances by 40 to 60 percent in active periods. High income comes for traders who build and use bots as it offers trade profit of over 1000 USD every month. This blog gives brief information about crypto trading bot development today.

What is a Crypto Trading Bot?

A crypto trading bot is a special software that keeps buying and selling digital coins without needing people to watch every second. It works by following fixed steps and plans that people set before the bot starts.

The tool keeps running through the day and night without stopping and does the trade work faster than people. Many traders now use this kind of Crypto Trading Bot to try and keep profits steady during both rising and falling price times.

Pre-Requisites For Setting Up an Automated Cryptocurrency Trading Bot:

1. Understanding the Crypto Market

A bot does not think. It always follows the settings and instructions given by the person who operates it. For this reason, some level of learning about how markets move is necessary. No bot will do well if the logic behind it is weak or not based on market behavior.

- Market Trends and Analysis: Market prices keep moving due to events like government news, investor choices, or sudden buying patterns. At times the prices go up fast during demand rises. Sometimes they fall when confidence goes away. People who know about such up-and-down patterns have better chances of choosing when the bot must act.

- Technical Analysis Indicators: Several types of tools are used to study prices. These tools are named indicators. They help traders understand if a coin will go up or down. Some common names in this group include RSI which tells if the market is too high or too low. Another one is MACD which shows when price direction may change. Without knowing these tools, it becomes hard to guide the bot correctly.

- Basic Programming Skills (if building from scratch): Some people want to build their bot by writing their code. For this goal, knowing how to use programming languages like Python or JavaScript gives them an upper hand. Though many platforms now give ready-made bots, when one codes their own, they gain more freedom and change options.

2. Accounts On Crypto Exchanges

Bots do not buy or sell coins on their own. They work only when linked with crypto exchanges where coins are traded. All exchanges do not allow bots. So one must pick a place that supports this setup.

- API Integration Requirements: Bots talk with exchanges through something called API. This is a tool that helps the bot check prices, place buying and selling orders, and look at balances. To make this link, the exchange gives some special codes called API keys. These keys must be kept private and safe because anyone with these keys can control the bot account.

- Supported Exchanges: Only some exchanges give good support for bots. Many exchanges are not built well enough or have tight limits that block bot functions. Some common names that do support bots and provide clear guides are Binance, Kraken, and Coinbase Pro.

3. Access To Essential Tools

When the bot is ready and linked with an exchange, the work is not complete yet. To keep the bot strong and working in all types of markets, more tools are needed.

- Algorithmic Trading Platforms: Some platforms help people set up bots without writing code. These tools give menus, settings, and plug-ins that make things simple. Some known names that do this job are HaasOnline, Cryptohopper, and 3Commas. They provide a Crypto Trading Bot to support different strategies and settings.

- Backtesting Tools: Any plan must be tested before it is used in live markets. Bot’s actions are examined with old market data. If the bot works well with past data, then there is more chance it may work in the future too. Sites like TradingView or QuantConnect help people test and adjust before real trading begins.

- Risk Management Frameworks: Crypto values do not stay fixed and can drop without warning. To reduce damage, rules must be used. These rules must cover when to stop the bot, how much to trade at one time, and how to divide the coin choices. When the bot follows safety plans, the losses stay low even during a bad market phase.

Different Types of Crypto Trading Bots to Create Your Own Bot

| 1. | Arbitrage Trading Bot – Triangular Arbitrage Bot and Flash Loan Arbitrage Bot |

| 2. | Market Making Bot |

| 3. | High-Frequency Trading Bot |

| 4. | Grid Trading Bot |

| 5. | Dollar-Cost Averaging Bot |

| 6. | Algo Trading Bot |

| 7. | Crypto Sniping Bot |

| 8. | Hedge Bot |

| 9. | Signal Trading Bot |

| 10. | MEV Trading Bot |

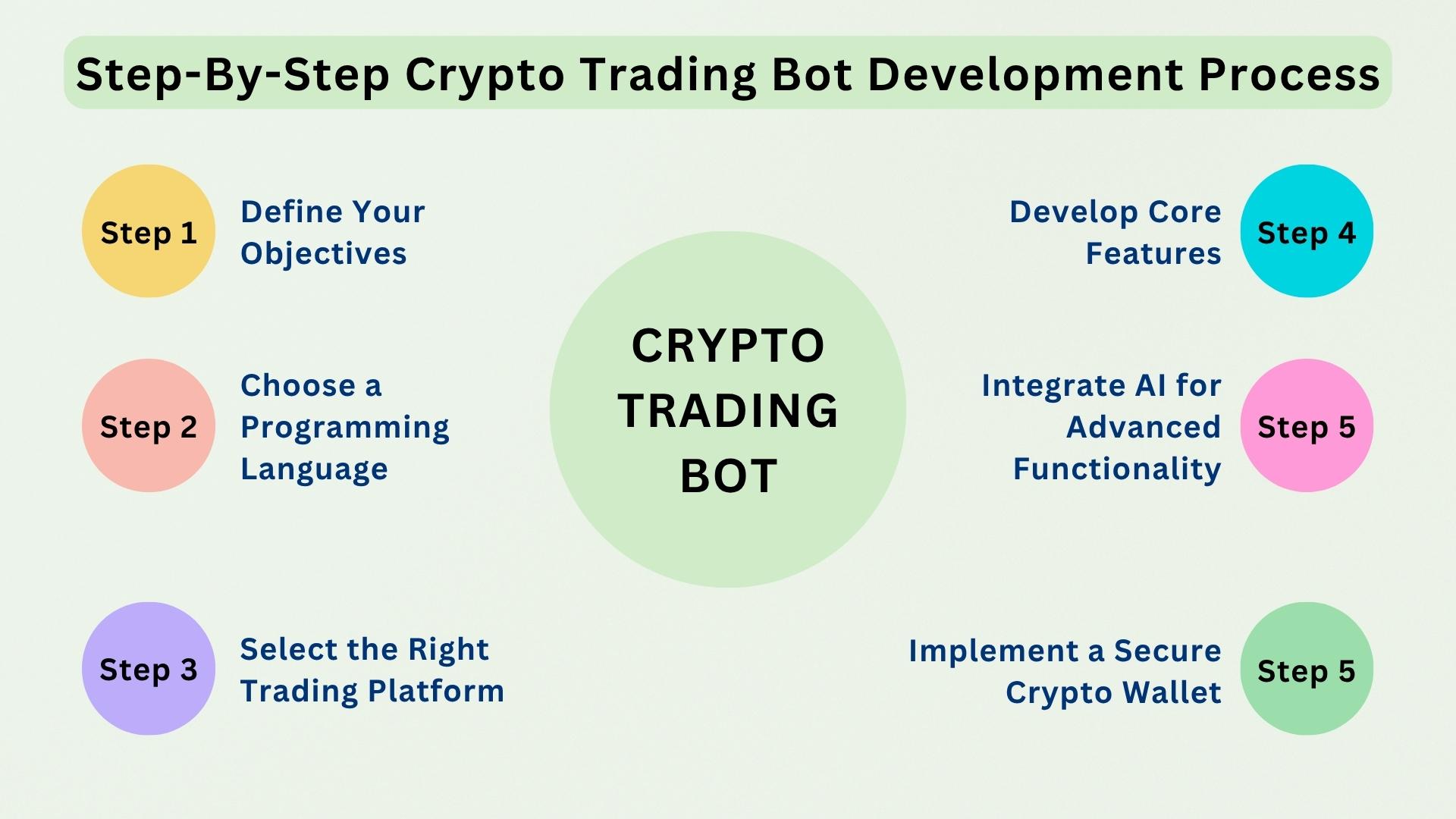

Step-by-Step Crypto Trading Bot Development Process

Step 1. Define Your Objectives

The first important step in making a crypto trading bot is to decide what kind of trading goal is planned. A person must think carefully about whether the bot should manage short-term trades, work for long-term investment patterns, focus on high-speed trades like scalping, or look for small price gaps across different exchanges.

Such planning in the beginning often gives a fixed path for the bot’s complete design and its working nature. When ideas are clear and steady from the beginning then the trading bot becomes easier to build for the desired purpose either to reduce risk or to gain short gains in fast market movements.

Step 2. Choose a Programming Language

A crypto trading bot’s strength often stays tied closely to the selected programming language. Many developers usually pick Python because it offers ease during creation along with wide libraries like NumPy or Pandas which assist in the proper handling of market data.

Java brings a stronger base for building fast trading bots where performance and stability remain very important. C++ though more difficult, brings better control when high-speed order placing is necessary. The final choice usually depends on the team’s skill level and how deep the technical operations must go within the trading process.

Step 3. Select the Right Trading Platform

To run and place trades a bot must be linked to a working crypto exchange platform. One must carefully choose platforms that give safe access methods through well-documented APIs and provide high asset liquidity. Binance offers many trading pairs which makes it useful for wide market access.

Kraken stands stronger with strict security support. Coinbase is often preferred when one needs easier access and clean design. These platforms support different API styles that allow placing orders and pulling data in real time with minimum delay. When selecting an exchange the key focus should stay on how simple it is to connect and whether the features match the trading tasks planned for the bot.

Step 4. Develop Core Features

Once goals and platform are fixed the main task begins which is the creation of core functions that the bot must carry daily. A bot should be able to look at market conditions and decide if any trading option looks good. It needs to check price charts and find changes using tools like RSI or MACD which are known in technical analysis.

In some setups, the bot can also learn price behavior using past data and give signs that say buy or sell. These trade signals must trigger real action by placing correct orders with no delay. When trades are made then risk rules must follow. Features like stop loss and take profit settings help keep gains in safe hands while cutting losses early during wrong trades.

Step 5. Integrate AI for Advanced Functionality

For more smart working patterns one may join artificial intelligence into the bot structure. When AI tools are used the bot can study price records and improve decisions over time without human help. Many trading bots today use AI to work with deep learning tools that look deeper into the market and guess future moves.

These AI tools check past price trends and also adjust methods when trade results change. Such ideas help make the bot smarter as it faces new trading scenes with better skills. This method suits traders who want more than just basic buy-sell logic.

Step 6. Implement a Secure Crypto Wallet

A crypto trading bot must hold and move funds in a safe way. For that reason, a secure digital wallet must be added to the bot. This wallet must be able to store, send, and receive tokens as per the trade need. Some people use a TRC20 wallet when dealing with a TRON or XDC wallet when sending tokens under the XDC chain.

Today some wallet types work together with AI to offer smarter ways of handling assets and keeping them secure. In some cases, teams contact wallet developers who create secure wallet parts that fit well into trading bots and meet safety points that match user needs.

Step 7. Test Your Bot Thoroughly

After building the bot the full platform must go through many checks before handling live money. A basic method is to run the bot using past data and check how it may have traded in earlier markets. This is known as backtesting and gives a rough idea of the results.

But testing must also include real-time work under a small balance to know how the bot reacts under live price changes. Such steps show how strong the bot works under sudden market jumps or large trade movements. Every test must end with changes in logic or settings if any flaw or delay is seen during the test period.

Step 8. Monitor and Update Regularly

The working nature of digital coins keeps changing and does not follow any fixed rule. So a crypto bot must not be left alone once it starts. Regular checks must happen where one sees if trade goals are met and if the bot gives results that match planned targets.

When new trends come in AI or exchange APIs then the bot must change slowly to catch up. Many developers now follow updated wallet tools like MPC-type wallets or smart contract work to improve the bot’s inside work. Every small market shift needs a fresh look at trade logic to keep the bot active and working in tune with the market’s fast nature.

Key Benefits of Developing a Cryptocurrency Trading Bot

- Efficiency and Speed: Cryptocurrency trading bots work fast and handle large amounts of data in a short time. Trading manually often causes delays. Sudden price changes lead to heavy losses. Bots act quickly and help reduce such risk by making faster decisions.

- 24/7 Operation: A bot keeps running all day and night without any break. Traders may sleep or stay away from screens but the bot continues working. Any market activity is noted and acted upon by the bot at any hour of the day.

- Emotion-Free Trading: Bots do not feel fear or greed. Emotional actions affect decisions. Logical trades made by bots are based on pre-set instructions and data alone. It helps in keeping the plan stable and focused.

- Customizability: Bots may follow the trading methods given by the user. Each person can choose styles like scalping for quick moves or long-term investing. The bot can match the trader’s personal choices and follow those without mistakes.

- Increased Accessibility: Ready-made bots and templates are now available on many platforms. People with little experience can also begin using them. No complex setup is needed to run these tools. Starting has become simple and faster.

- Handling Market Volatility: Digital coins often shift in price without warning. Sudden spikes or drops can confuse traders. Bots respond faster during such periods. They may adjust the trades without waiting. Such ability helps to reduce losses when the price keeps changing.

Tips For Optimizing Your Automated Crypto Trading Bot:

1. Monitor Market Volatility

Price movement in digital coin markets does not follow a fixed path. So it helps to include triggers based on sudden price action. Set alerts that react when prices move up or down by a fixed percent in a short time. Some bots can change their strategy when the market mood shifts.

One may use a strategy for rising prices and another for price drops. Fast-moving prices may cause the bot to make trades at the wrong price. Small changes in how the bot places the order might reduce this problem.

2. Implement Risk Management Parameters

Even smart bots fail when risk control is missing. Protection steps in the trading plan help prevent large money losses.

- Stop-Loss and Take-Profit Mechanisms: Stop-loss points are used to close a trade if the price goes too low. This avoids losing more. Take-profit closes the trade after a target is reached so that gains are saved.

- Portfolio Diversification: Money must not stay in one single coin. Using different cryptocurrencies can lower the chance of big losses. Bots that handle many trading pairs help divide the risk.

- Position Sizing Strategies: Decide on capital. A small part of total funds, maybe 1 or 2 percent, is safer. Such size rules protect the balance when a trade does not go well.

3. Regular Updates and Maintenance

A bot must not run without attention for long. Digital markets shift fast and without a pattern. Always look back and check if the trade plan still matches the current condition of the market. If the code was written, make sure the software is current.

If using a bot from a company, check that it stays updated too. Watch bot perform. Look at profit numbers and review each trade. Change the settings when needed to keep performance steady.

Why Pick FireBee as Your Crypto Trading Bot Development Company?

- Highly Experienced Team: We always work with focus and care. Our team holds strong knowledge from many completed projects. We follow tested methods and build each crypto trading bot with attention to logic and structure. Our work stands on real experience. We never rush the process because every feature must work right without fail.

- On-time Project Delivery: We work with speed but never drop quality. Our team sets a clear deadline and follows it. We divide the project into stages and check each part before moving ahead. We never skip testing or safety checks. You get the bot on time.

- Affordable Pricing: We offer fair prices for every project. Our cost plan stays fixed after discussion. We never add extra charges later. We explain every step of the work clearly. You will see how we move from plan to delivery. We keep our timeline honest. Our answers come fast when you reach out.

- Security Focused Process: We add safety to all parts of the bot. Our code stays clean and follows strict checks. We protect wallet links and trade access. Our Crypto Trading Bots block unwanted commands. We test everything again and again before final use. You can trust the product because we build it with safety as our base.

- Long Term Support: We stay with you even after delivery. Our team helps with updates and changes. We can improve the bot when the market changes. You can call us for fixes or support at any time. Our team answers with care and speed. We want your trust to grow with time.

Conclusion:

Building a crypto trading bot in 2026 stands as a thoughtful choice for anyone who wants to enter a steady income field. Profit can grow slowly when one uses a well-made crypto trading bot that stays ready all the time without delay. Development of such bots needs careful logic, good tracking, and a full setup that never misses the price flow and trade signals. Traders who aim to build profit from crypto bot development must begin with skilled help.

Fire Bee Techno Services is a reputed crypto trading bot developer that offers custom trading bots with full planning and trusted development paths for people who want better outcomes through automated crypto trade operations. Connect with our expert team today and begin your trading in crypto automation with assured profitability.

- Written by David- A skilled blockchain and crypto content writer with deep knowledge of trading bots and web3 platforms. With years of writing experience in crypto, He support startups, entrepreneurs and business teams by giving clear and useful content. His work always aims to guide readers through practical solutions and achieve real business goals.

Our Service Page:Crypto Trading Bot Development Company